Despite several ways to save on car insurance, it may not be as simple as it sounds.

It was early September when I started searching for ways to get a discount on auto insurance. The reason was that my premiums had gone from under $2,300 for 6 months last year to nearly $3,100 this year. Without having reported any accident or violation, the $800 increase seemed overwhelming. Here are the things I’ve researched online and offline, and talked to agents to save on my premiums.

Deductibles and coverage limits

The fastest, easiest, and most effective way to lower your premium is to increase your deductible or lower your coverage. Depending on the amount, some people have seen savings of 20% or more.

However, experts do not recommend this. My current insurance policy covers $100,000 per person and $300,000 per accident for bodily injury, including medical expenses, in case of an accident caused by my fault. If I lowered this to the state’s minimum requirement of $15,000 and $30,000, my premiums would go down, but with the recent increase in auto prices and the cost of repairs, you may find yourself in an accident without enough coverage and paying out of pocket. Raising your deductible can be a bad idea likewise.

“If you have property, it’s essential to have high limits,” said Farmers Insurance agent Steve Jin. To protect myself against a hefty liability from a major accident, I decided to avoid adjusting deductibles and limits.

Insurance company discounts

If you’ve been with the same insurer for more than five years, have home and auto insurance with the same company, or insure two or more cars on one policy, you may be eligible for a discount. You can usually save 5-20% on your premiums. The problem is, I am already getting these benefits. There were very few additional discounts available.

Comparing with other insurers

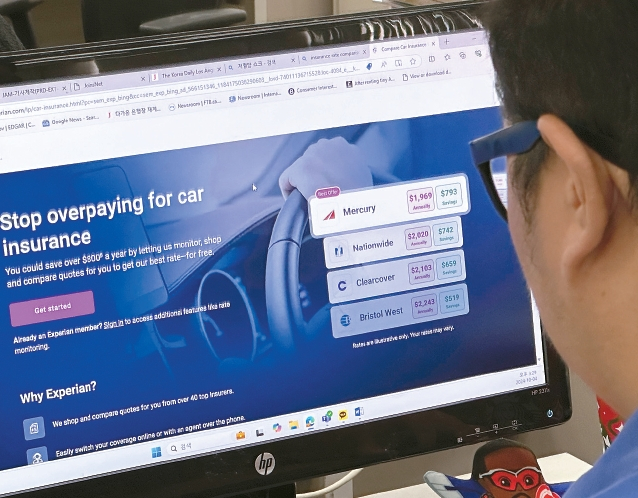

Experts say that you can only get cheap insurance if you actively “shop around”. The idea is that you need to switch carriers to find a lower rate.

However, Costco did not accept California drivers and other auto insurance companies either said they couldn’t accept new applicants or that they’d get back after a two-week review period. Some of them never got back to me.

Although I tried using an online platform to compare prices by entering all of my vehicle information, residence, marital status, and employment, the results were quite disappointing. Only one company offered a product cheaper than my current premium, and all the others were much more expensive.

One of them even quoted me an insurance rate that was over $2,000 more for six months premium.

The one with the cheaper rate had lower coverage limits than my existing policy. Raising it to the current level would have resulted in a much higher premium than I was paying now.

One important thing to note here is that after entering my information into the comparison sites, I was bombarded with spam calls from small, unrecognizable insurance companies.

Don’t pull a trick

Some people say there are ‘tricks’ to dramatically reduce insurance premiums. These include moving the address to a suburban area with less traffic and fewer accidents, or drastically reducing the number of miles you drive in a year. However, experts pointed out that violating the principle of good faith and providing false information is technically insurance fraud.

If you get into an accident in such a situation, you may not be able to get coverage, and it could also result in penalties, they said. “If you try to reduce your premiums in an unjustified way, you could end up in more trouble,” said David Lee, an agent at Cal-Kor Insurance.

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]

![Green card interviews used as decoy for ICE arrests U.S. Immigration and Customs Enforcement (ICE) agents arrest a man after a hearing at an immigration court in Manhattan, New York, on Oct. 27. [REUTERS]](https://www.koreadailyus.com/wp-content/uploads/2025/12/1226-ICE-100x70.jpg)