By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

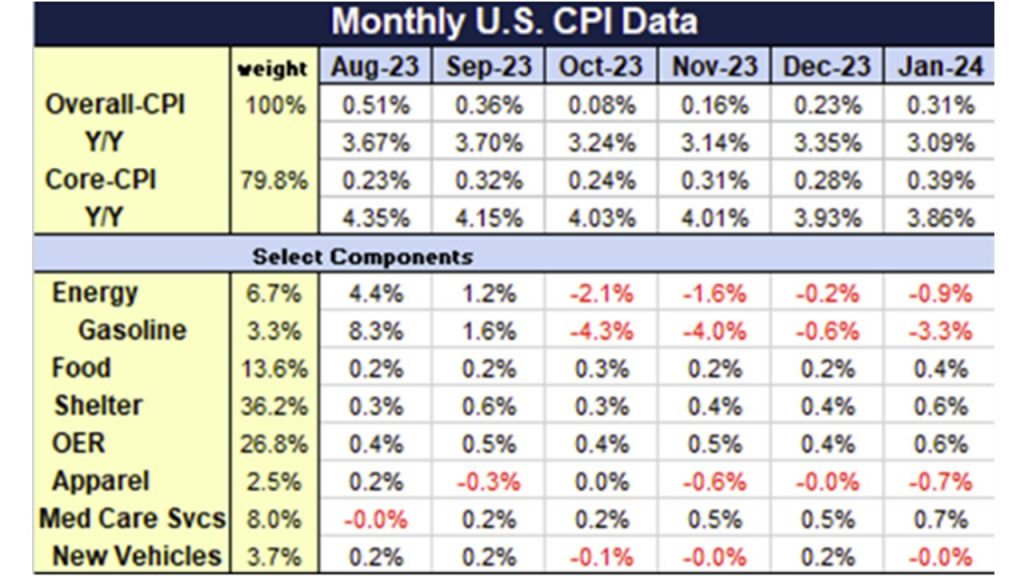

In January, the Consumer Price Index (CPI) increased by 3.1% from the previous year, a slight decrease from December’s 3.4% rise. Shelter, making up 33% of the CPI, was a significant factor, contributing to two-thirds of the price increase. Excluding shelter, the inflation rate would have dropped by 2.79%. Given that actual rents are decreasing, we can expect the housing component of the inflation measure to decline eventually.

Food prices have also been a burden, rising 2.6% from the previous year, which has kept consumer confidence in the economy low despite some recent improvements. A major factor behind the increase in food prices is labor costs. For instance, wheat only makes up about 5% of the cost of a loaf of bread, while labor and distribution costs account for about two-thirds of its price.

Progress towards the central bank’s inflation target of 2% is ongoing, but challenges remain, particularly the so-called “last mile problem.” During the pandemic, supply shortages contributed to roughly half of the inflation rate. However, the recent easing of these shortages has helped lower inflation towards the Federal Reserve’s goal. This situation highlights the complexity of reducing inflation to the target level amidst a strong labor market.

The economy has seen healthy growth, with the labor market not only recovering but thriving. This has led to higher real wages, improved consumer purchasing power, and further consumption and economic growth. The strength of the job market was especially evident in the robust January jobs report, which presents a challenge in controlling inflation during such economic vitality.

The central bank is also concerned about inflation in service prices, partly due to a tight labor market in sectors like healthcare, leisure, hospitality, and construction. This has resulted in higher costs for services, from dining out to personal care and insurance, with service prices excluding energy rising by 5.4% from the previous year. This “cost-push inflation” is less responsive to interest rate changes, influenced by factors such as significant labor agreements, minimum wage increases, and slow productivity growth.

The reduction in inflation, helped by falling energy prices, may not persist, complicating the challenge of achieving the 2% inflation target. If goods prices do not continue to fall, reaching the target becomes more difficult. Conflicts in regions like the Middle East could further impact supply chains and prices, adding to the complexity of stabilizing inflation.

The Federal Reserve faces a challenging task in balancing economic growth and employment while trying to control inflation. A careful and nuanced approach may be necessary, potentially delaying interest rate cuts until there is clear evidence that inflation is consistently moving towards the target. Following the release of the latest inflation report, the likelihood of a rate cut at the May 1 Federal Open Market Committee (FOMC) meeting has decreased to 36% from over 50%.