Understanding how tax law changes affect you can help you get a bigger refund in a faster time. Last year, the income tax filing deadline was extended twice by up to six months in some areas due to extreme climate events, but this year it will be due as usual on April 15. Taxpayers can file for an extension to October 15.

These are the main things you need to know about filing your taxes this year. For more detailed information and questions about each topic, visit the Internal Revenue Service (IRS.org), California’s Franchise Tax Board (ftb.ca.gov), the Good Hands Foundation (goodhandsfoundation.org), which provides free tax preparation services, or your tax professional.

Standard deduction

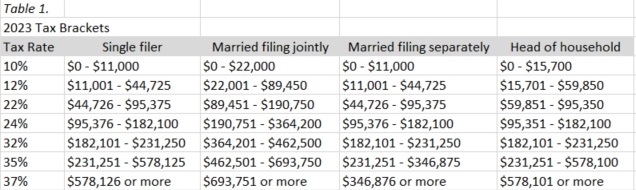

For tax year 2023, the standard deduction is $13,850 for singles, an increase of $900 from the previous year, and $27,700 for married couples filing jointly, an increase of $1,800. Married filing separately is $13,850 and head of household is $28,000. The income brackets have also been expanded, with the 10% tax bracket for singles under $11,000 increasing by $735 from the previous year, and married couples filing jointly increasing by $1,450 to $22,000. (See Table 1.) The 22% bracket for singles ranges from $44,726, up $2,950 from the previous year, to $95,375, up $6,300, and for married couples filing jointly, from $89,451, up $5,900, to $190,750, up $12,600.

Earned Income Tax Credit (EITC)

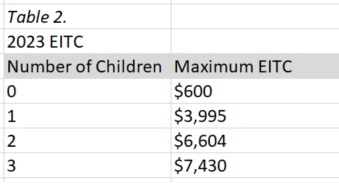

The Earned Income Tax Credit (EITC), which is one of the earned income tax incentive programs available on federal tax returns, provides tax refunds to low-income workers and families and supports the economically disadvantaged. The EITC varies based on a worker’s income and family size, with a maximum credit of $3,995 for a family with one child and $7,430 for a family with three children in 2023 (see Table 2). Beneficiaries with no qualifying children must be 25 to 65 years old as of 2023 to claim the $600 credit. Families or individuals earning up to $39,950 per year in 2023 can claim a CalEITC of up to $3529 using Form FTB 3514.

Child Tax Credit (CTC)

The Child Tax Credit, which can be claimed for children under the age of 17 who have a social security number allowing them to work, can be claimed for up to $2,000 per child. The credit is currently capped at $1,600, but if the CTC expansion bill gets approved, it will increase to $1,800 for 2023, followed by $1,900 for 2024 and $2,000 for 2025. Taxpayers can claim the child tax credit if their adjusted gross income (AGI) is up to $200,000 for singles or heads of household or $400,000 for married couples filing jointly. Taxpayers who pay to care for a dependent child under age 13 or another family member while working are eligible for the Child and Dependent Care Credit, regardless of income. They can claim up to 35% of their childcare expenses, capped at $3,000 per dependent and $6,000 for two or more. At 35%, the deduction is $1,050 and $2,100, respectively.

Standard Mileage Rates

The standard mileage rates for automobiles have been updated. For vehicles used for business purposes, the deduction will be 67 cents per mile, up 1.5 cents from 65.5 cents last year. For qualified active duty military personnel driving for moving or medical purposes, the deduction is 21 cents per mile, a decrease of 1 cent from last year. Vehicles operated by charitable organizations remain unchanged at 14 cents per mile. Mileage expenses are deductible for gas and diesel-powered vehicles, including passenger cars, minivans, pickup trucks, and panel trucks, as well as electric and hybrid vehicles. There’s also the ‘actual car expenses’ method, which allows taxpayers to deduct the actual costs of car care and maintenance, such as car washes, gas, insurance, repairs and maintenance, lease payments, parking, and depreciation. However, they have to choose one or the other. If you choose the standard mileage rates for a leased vehicle, you must use the standard mileage rates for the duration of the lease and any extensions.

Electric Vehicle Tax Credit

If you purchase an electric vehicle (EV), plug-in hybrid (PHEV), or fuel cell electric vehicle (FCV) that qualifies for an Inflation Reduction Act (IRA) in 2023, you can claim a credit of up to $7,500 for new vehicles and up to $4,000 for used vehicles. However, this only applies if you owe taxes on your tax return, and if your tax bill is less than $7,500 for a new car or $4,000 for a used car, you won’t get the difference back. However, as of January 1 of this year, eligible individuals can use the credit as a down payment for up to $7,500 for a new car or $4,000 for a used car, and take it to the dealer for a discounted price. To qualify for the credit, the annual income limit is up to $150,000 for singles and $300,000 for married couples filing jointly. The credit is subject to eligibility based on conditions such as where the car is assembled and where the parts are made, so vehicle owners should contact your dealer for details.

Residential Clean Energy Credit

The Residential Clean Energy Credit is available for up to 30% of the cost of qualifying clean energy equipment installed in new homes from 2022 through 2032. The credit rate phases down to 26% in 2033 and 22% in 2034. The tax credit is available for energy-saving improvements to windows, roofs, and interior materials, including solar panels. The credit is applied as a credit in the year of construction. If you owe less tax than the credit, you can carry forward any unused excess credit and use it to reduce your tax liability in future years.

1099-K

The app transaction tax reporting rule, which was scheduled to take effect in 2023, has been delayed once more. The tax reporting rule requires platforms to issue a 1099-K form for transactions of $600 or more paid through money transfer apps like PayPal and Venmo or third-party platforms like eBay, Airbnb, and Etsy. After being delayed last year and again this year, 1099-K forms will be issued for transactions over $20,000 for the tax year 2023, $5,000 or more starting in 2024, and finally $600 or more starting in 2025. Gifts between individuals and money received from family or friends are not considered taxable income.

BY NAKI PARK, HOONSIK WOO [park.naki@koreadaily.com]