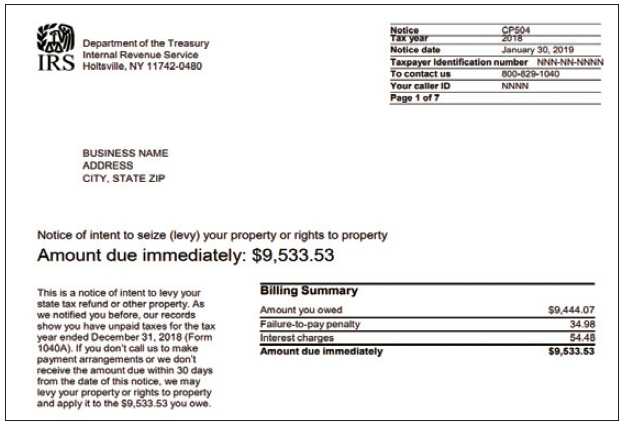

As the IRS has resumed sending delinquency notices and stepped up collection of unpaid taxes, taxpayers are increasingly receiving notices of tax delinquency and property levies, many of which are from IRS mistakes.

In July, one Koreatown resident who asked for anonymity received an unexpected notice from the IRS. It said he owed back taxes for 2022 that he had already paid in full. The penalties and interest added up to a substantial amount. When he checked, he realized that the IRS had mistakenly processed his 2022 tax payment as a 2023 tax payment due to a system error. He didn’t owe any additional money but had to go through a lot of inconveniences to resolve the issue, including providing supporting documentation.

One resident of Fullerton received a notice that his 2021 taxes were delinquent and foreclosure could begin in 30 days. Frustrated about the notice, he thought about paying the taxes listed on the notice right away, but since he had never been late on her taxes before, he contacted his CPA. He was told that the IRS made a mistake and didn’t apply some tax credits, resulting in a delinquency, but that he didn’t owe any taxes.

According to tax experts, delinquency and levy notices resumed late last year after being suspended shortly after the COVID-19 pandemic.

“Notices that were backlogged for three years are now being sent automatically,” said James Cha, CPA.

In addition to the automated system’s fair share of errors and rookie agent mistakes, taxpayers are seeing more incorrect delinquency or levy notices than ever before.

“In July and August, many taxpayers received notices of delinquency, but many of them were incorrect, such as being asked to pay back taxes they had already paid or not being processed as fully paid due to a mistake on the IRS’s part,” said one tax expert. For self-employed individuals in particular, he added, the pandemic has complicated tax filing with a number of increased tax credits, which have been overlooked.

“In some cases, clients who owed taxes received tax refunds for the same amount,” said one CPA. An anonymous expert added, “I had a client who just saw the notice and had to re-pay taxes they had already paid, and it took months to process the refund.”

“Many taxpayers get scared when they receive an IRS notice,” experts said, adding that ”there are also error notices, so it’s always beneficial to consult with a tax professional.” Furthermore, ignoring an IRS notice and not taking action can result in penalties and interest that can add up to a large amount to the point it becomes unaffordable, so it’s best to seek professional help to ensure you’re taking the right steps, they emphasized.

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]