By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

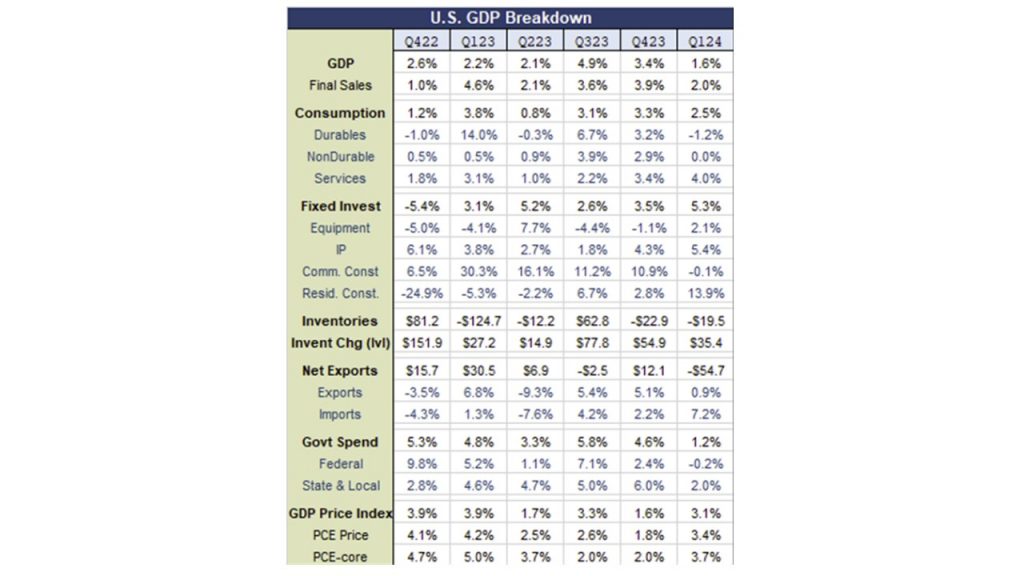

Since March 2022, the Federal Reserve has implemented eleven interest rate hikes. While these adjustments have succeeded in tempering economic growth, they have been less effective in controlling inflation. The economic growth rate has slowed significantly, recording a 1.6 percent annual rate in the first quarter, a drop from 3.4 percent in the last quarter of 2023.

Although service industries have shown some zip, spending on goods has decreased. Healthcare, financial services, and insurance have remained strong, while the automotive, gasoline, and inventory sectors have negatively impacted economic growth.

Meanwhile, inflation has not slowed in tandem with economic growth. The broadest measure of inflation, the GDP deflator, increased from 1.6% to 3.1%. The core inflation rate jumped from 2.0% to 3.7% excluding food and energy. This disparity between the cooling economic growth and rising inflation rates has prompted a negative initial response from the stock and bond markets.

The current economic conditions reflect what I describe as a “Rolling Recession.” Housing, which initially suffered, has shown a significant recovery, with residential investment increasing at an impressive annual rate of 13.9% after a dismal 2023. Meanwhile, imports have rebounded, detracting from overall economic growth, and the falling trend in goods sales has led to an increase in unwanted inventories.

To address these excess inventories, sectors such as motor vehicles, furniture, and recreational vehicles have reduced production. Consumer spending, traditionally a primary driver of the economy, has shown signs of weakening, growing at a reduced annual rate of 1.7 percent, down from 2.2% in the previous quarter. A “Rolling Recession” generally results in a less severe overall economic impact than a traditional recession.

Facing such a mixed economic landscape, the Federal Reserve’s next steps are critical yet uncertain. Although some market participants anticipate a rate hike or two, there are compelling reasons for interest rates to trend downward. If the economy shows further signs of slowing—potentially due to previous rate hikes, persistently high inflation, or decreasing consumer spending—the Fed might reduce interest rates to cushion an economic slowdown. Moreover, if inflation continues to trend down, it could prompt the Fed to lower the interest rate.

In conclusion, the decision to raise or lower interest rates in 2024-25 will depend on various factors, including inflation trends and broader economic and global uncertainties. This complex interplay makes economic forecasting especially challenging, with new data and developments potentially altering the outlook.