With the possibility of a September rate cut now almost being at certainty, consumers are turning to certificates of deposit (CDs) as a safe place to invest before rates go down.

CDs became a popular safe haven as interest rates remained in the 5% range after a sharp increase in the Fed’s interest rate with banks having since competed to attract deposits. However, with the prospect of a rate cut next month, some banks have lowered their CD rates already. This may be the last chance to get CD products with a rate in the 5% range.

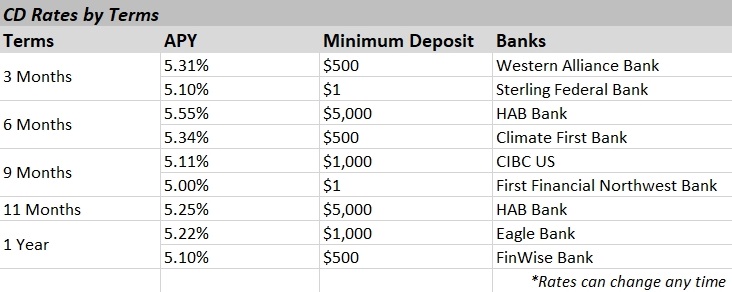

The Korea Daily checked financial information websites that compare CD rates, as well as banks’ websites to find CDs offering rates ranging from 5.50% up to 5.50%, depending on the maturity. Short-term CDs with maturities of one year or less are particularly attractive to investors, with many banks offering rates above 5%.

The most prominent is HAB Bank’s CD offering 5.55% for a six-month term. While the $5,000 minimum deposit is higher than other products, the rate is more than 0.2 percentage points higher than other banks.

Because of the anticipated rate cuts, extreme shorter-term products, such as three-month terms, have higher rates than longer-term products of one year or more. However, it’s beneficial to compare CDs from different banks, as a one-year term may have a higher rate than a nine-month term. This is because banks are competing for customers, and different banks often offer higher-than-average rates.

Financial experts agree that this month is the last chance to buy high-interest CDs, as the Fed is expected to cut rates. In fact, in June, the average for 3-month and 6-month CDs was 5.30%. But looking at recent rates, it’s tough to find many that pay more than 5.30%.

However, there are things to keep in mind. Most CDs come with early withdrawal fees if you withdraw your money before maturity. These fees vary from bank to bank, so be sure to read the fine print before you buy.

You should also check whether the bank you’re considering is insured by the Federal Deposit Insurance Corporation (FDIC). FDIC-insured financial institutions protect depositors up to $250,000 per bank in the event of bankruptcy. Some banks may no longer offer the rates they advertise online, so it could be better to go into a branch, if they have one, to get a better deal, experts said.

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]