The recent “2023 National Korean American Economic Survey” conducted by the Korea Daily found that the proportion of private businesses has declined, with a shift in favor of larger revenue businesses.

The homeownership rate is at its highest since 2006 when the survey began, and the value of owned homes has risen sharply. In terms of income, the Korean-American economy has returned to its pre-pandemic level, with fewer low-income earners and more high-income earners. The proportion of retirees has risen dramatically, accelerating generational change in the Korean-American community. The survey polled 5,016 Korean Americans nationwide.

Self-employment

The most common industries for Koreans who own private businesses were the hospitality industry (21.9%), wholesale or retail (19.3%), and restaurants (15.9%). In 2020, hospitality (23.9%), wholesale or retail (18.6%), and food services (15.1%) were also the most common industries.

When it comes to the number of employees, 89.5% of respondents reported having 10 or fewer employees, which is almost unchanged from 90.5% in the 2020 survey, indicating that Korean-American businesses are still largely small businesses.

Notably, when asked about overall revenue, the percentage of respondents who reported revenues of $1 million or less dropped significantly from 85.5% in 2020 to 72.1% in 2023. The number of private businesses also dropped by more than 10% from the 2020 survey. Many small businesses were likely unable to survive the pandemic and either closed or chose to retire. As a result, Korean American private businesses are being reorganized, with higher-grossing businesses surviving.

In the Java market, small businesses have also disappeared since the pandemic, with only large companies surviving. “Small businesses have been largely liquidated in the aftermath of the pandemic and the recession that began in earnest in mid-2023,” said an official from a Korean-American bank, adding that “many micro and small business owners have closed down, sold their businesses to others, or taken early retirement due to the difficult conditions.”

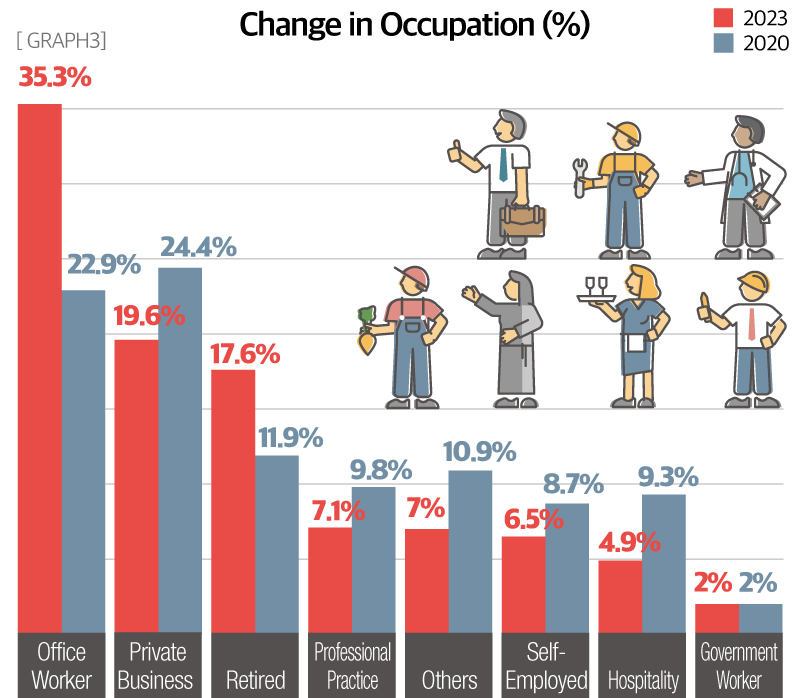

Housing

The homeownership rate among Korean Americans was 55.4%, while the rental rate was 44.6%. In 2020, the ownership rate (48.4%) and rental rate (47.0%) reversed for the first time, and the gap widened in three years. The 1.4% gap grew to 10.8%, more than seven times larger.

According to data released jointly by the Federal Reserve and the Census Bureau, the national homeownership rate rose sharply from 64.2% to 67.9% from 2019 to 2021. The home-buying frenzy spurred by low interest rates and the trend toward working at home has been replicated in the Korean American community.

The rising value of Korean-American-owned homes is also evident in the Home Value Survey. In 2020, nearly half of respondents (46.9%) said their home was worth less than $600,000, but by 2023, that number had dropped to nearly half (24.8%). On the other hand, the percentage of respondents who said their home was worth $1 million or more increased significantly. The percentage of homes valued between $1 million and $1.5 million more than doubled from 10.7% in 2020 to 23.0% in 2023, and the percentage of homes valued at $1.5 million or more tripled from 3.3% in 2020 to 9.9% in 2023.

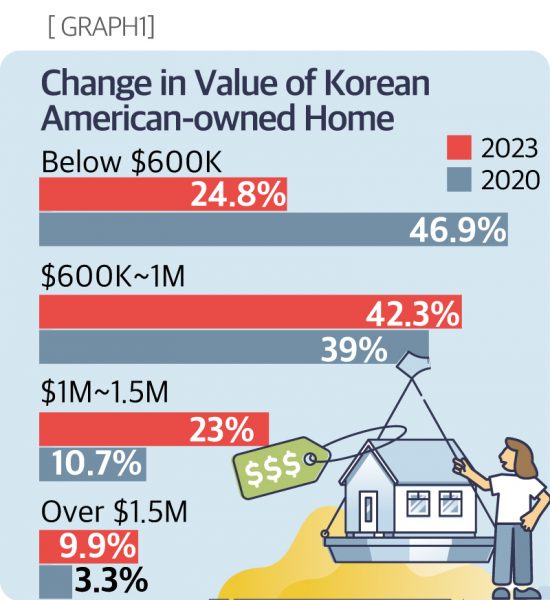

Income and debt

The most notable change in income is the decline in low-income households. The percentage of respondents earning $50,000 or more dropped to 36.9%, down more than 10 percentage points from 48.0% in 2020. The percentage of those earning $110,000 or more per year, which is typically categorized as high-income, rose to 20.7% from 13.2% in 2020. This indicates that the income levels of Korean Americans who were hardest hit by the pandemic have returned to normal, with some earning more due to increased investment income. The percentage of respondents who reported annual incomes of $200,000 or more has been steadily rising, from 0.8% in 2012 to 2.5% in 2020 and 4.3% in 2023.

More than half of respondents or 52.5% were in debt. The main reasons for debt were to cover living expenses (60.9%), to finance a business (29.6%), and to pay for children’s education (29.6%). The high percentage of Korean Americans who took on debt for living expenses even as their income level increased shows that even high-income earners are struggling with high prices and the economic downturn. This is not just a problem in the Korean American community. In early 2023, Lending Club found that more than half (51%) of high-income earners earning $100,000 or more per year said they were living paycheck-to-paycheck. That’s up nine percentage points from 42% the year before.

By age group, the data points show the priority of spending money. The proportion of people who said the main reason for debt was to fund their business was higher among those in their 40s, 50s, and 60s, indicating that this age group is more likely to start or run a business. The percentage of respondents who borrowed money for their children’s education was highest in the 40s and 50s, showing the struggles of parents with children before they graduated from college.

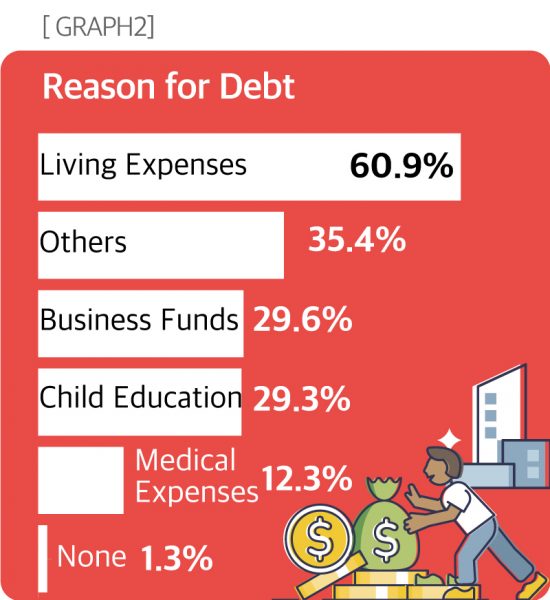

Occupation

The proportion of retirees and office workers increased significantly, while the proportion of private businesses decreased. The proportion of retirees jumped from 3.2% in 2012 to 11.9% in 2020, and then to 17.6% in just three years. For the first time, the share of private businesses fell below 20%, at 19.6%, after hovering in the low-to-mid 20% range for five surveys since 2006. The trend of having fewer business owners and more retirees coincides with the retirement of many first-generation immigrants who built their economic foundations on running a business.

In 2020, the number of people who reported that they were office workers jumped to 35.3%, up from 22.9%. However, in the 2012 survey, 40.1% of respondents were employed. This reflects the fact that the proportion of employed people plummeted during the height of the pandemic due to layoffs, but the employment situation improved back three years later. The share of the self-employed more than doubled to 8.7% in 2020 from 3.6% in 2012, before falling back to 6.3% in 2023, referring to the sharp increase in the number of Korean Americans who entered the food delivery business through app-based platforms such as Uber during the pandemic, but then decreased again.

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]