By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

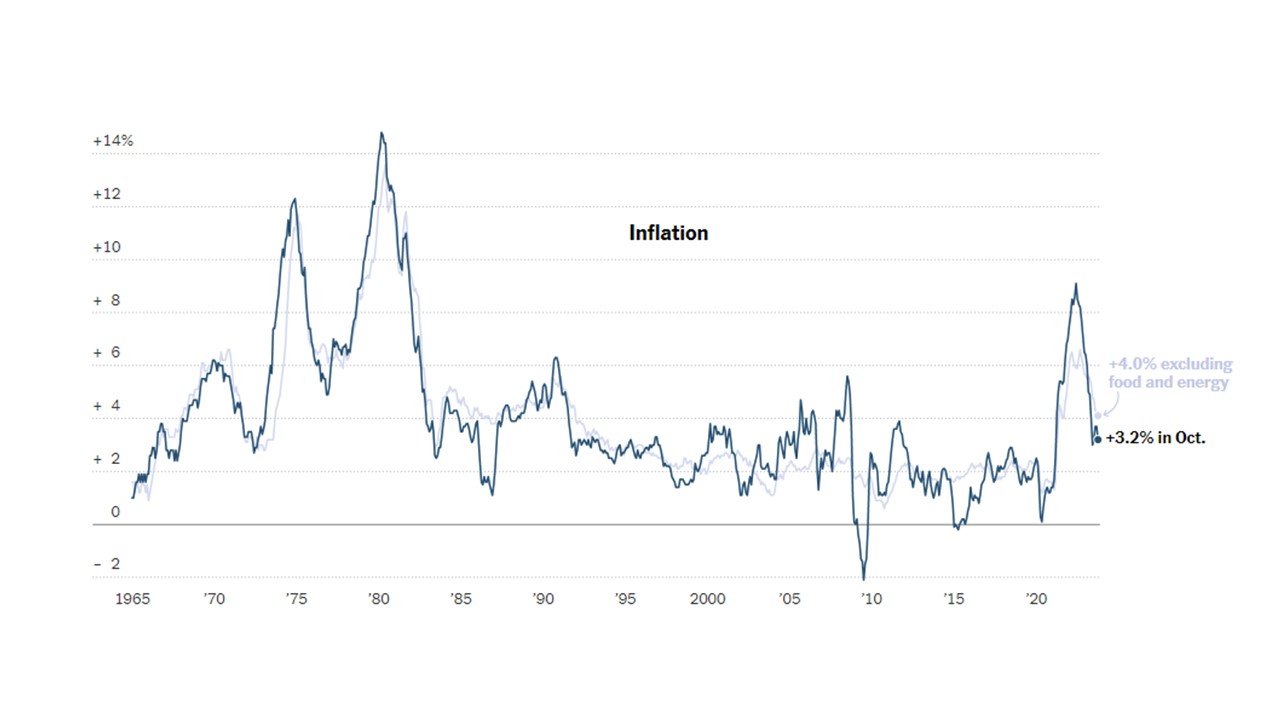

The CPI for October was flat, showing a continuing cooling trend for inflation. For the past twelve months, the inflation gauge slowed to 3.2 percent for the month from 3.7 percent during the previous month. This is indeed good news for the financial markets. The slowing inflation rate is a good predictor of the interest rate and the stock market.

The Chicago Mercantile Exchange (CME) predicts that the Federal Reserve will cut the interest rate by 0.25 to 0.5 percent by the end of July. However, the FOMC won’t be cutting the interest rate anytime soon. There is a small chance that the central bank would hike the rate in December. Chairman Powell reiterated that the inflation fight is far from over.

After the supply shock during the pandemic, housing costs were a big contributor to inflation. The good news is that shelter costs decelerated to 0.3 percent in October from 0.6 percent in September; it still rose 6.7 percent from a year ago. Hopefully, the housing component of the CPI will be a bright spot in the future. Actual rents have been falling for a while: this should be reflected in the CPI in the future. As the declining rents are reflected in the shelter costs, the service component of the CPI, a large component, should further improve. Good prices, led by used car prices, airfares, etc. continue to slow.

The war in the Middle East has not been a significant factor and the price of crude oil has fallen. However, uncertainties related to the fighting will remain for an extended period keeping the financial markets and Federal Reserve cautious.

Labor cost, which explains a lion’s share of the CPI, has been trending down pointing to further improvement in the inflation picture. Average hourly earnings slowed to 4.1 percent in October from September’s 4.3 percent. The Wage Tracker published by the Federal Reserve Bank of Atlanta showed wage gains of about 5.2 percent in October, down from 6.1 percent in December.

However, it is too early to be optimistic about wage inflation. After lagging well behind inflation, wages have a lot of catching up to do. The recent hefty settlements in the auto industry following transportation and delivery sectors point to the renewed strength of labor unions and upward pressure on the inflation rate.

Monetary policy remains “data dependent”. The softer October jobs report indicated that the economic momentum is slowing, and the inflation has been decelerating. Even though Chairman Powell emphasized that there is more work to be done on the inflation front and has not ruled out another hike in the interest rate, raising rates might further hurt business and consumer spending pushing the economy into a recession.

Holding rates steady can provide stability and predictability for financial markets, especially during uncertain times. This approach signals a wait-and-see attitude, allowing the central bank to gather more data and adjust later. The optimal decision for the central bank depends on its assessment of future risks and its policy objectives. Historically, during times of geopolitical tension combined with domestic economic strength, central banks have often leaned towards a more cautious and accommodative stance.