By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

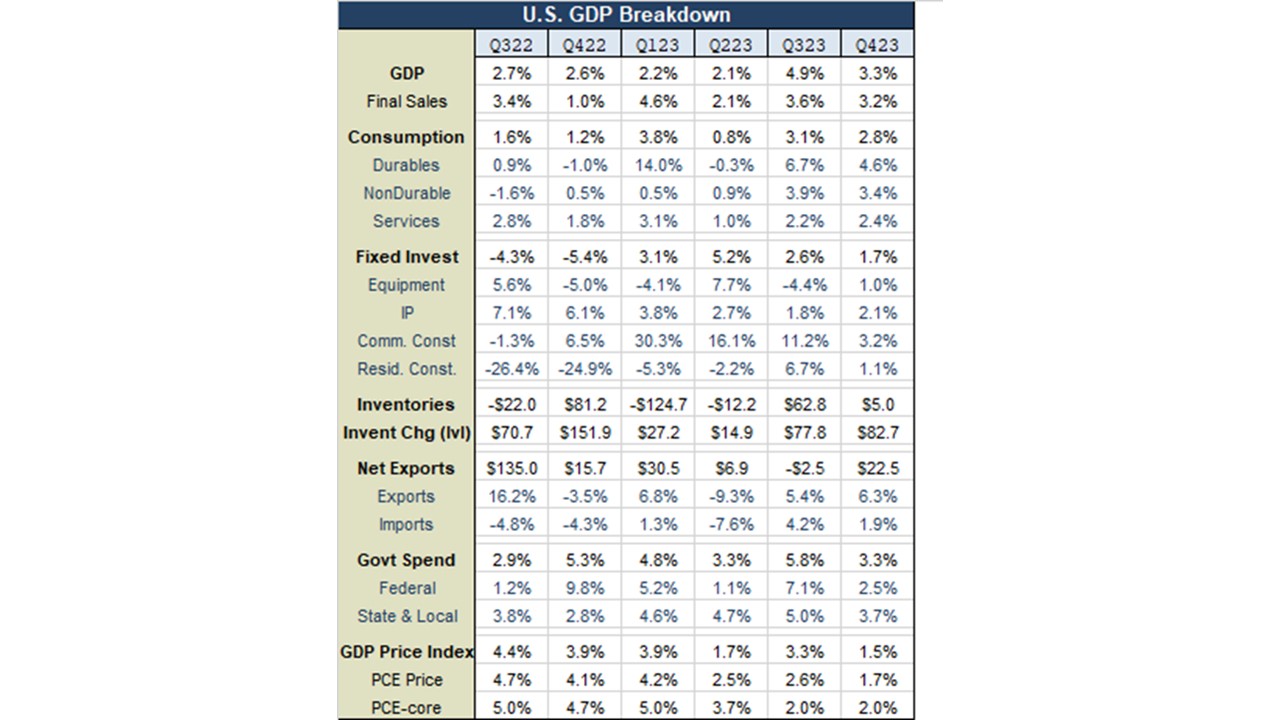

The economic growth during the fourth quarter of 2023 expanded at a slower, but impressive annual rate of 3.3 percent, surpassing expectations. Initially, both stock and bond markets reacted positively to the news. This robust growth was fueled by strong consumer spending, including the holiday season. A solid job market underpinned this growth, and the diminishing impact of inflation enhanced consumers’ buying power.

Looking ahead to 2024, economic growth is expected to slow further, but a recession is not in sight. A key concern is the lagging impact of previous interest rate hikes, the full effects of which on the economy and inflation are yet to be fully realized. Typically, it takes 1.5 to 2 years for monetary policy changes to fully permeate economic growth and inflation. Moreover, the rising federal funds rate, when adjusted for inflation, has been rising signaling potential challenges for the economy.

The strength of consumer spending, the driving force of the economy in 2023, is likely to lose some steam in the coming months. The government stimulus related to the pandemic significantly boosted consumer expenditure on a wide range of products and services. However, the era of lavish spending is drawing to a close as the excess savings dwindle.

Caution is now the watchword among consumers, with those on the lower economic rung increasingly resorting to credit cards. Credit card debt has soared past $1 trillion, accompanied by rising delinquency rates. Furthermore, the cooling job market is restraining overall purchasing power and consumer confidence.

Throughout much of 2023, government-funded construction projects, such as factories and manufacturing facilities, were significant economic drivers. These projects, bolstered by the Biden Administration’s CHIP and IRA Acts, notably boosted construction spending. However, the influence of this government stimulus has begun to diminish, with its stimulative effect on economic growth expected to decrease gradually.

Several other concerns loom on the horizon. The ongoing conflict in the Middle East stands out as a primary worry. An escalation of this turmoil could lead to a spike in crude oil prices, with far-reaching repercussions. Such a development could rekindle inflation and negatively impact economic growth.

Despite these concerns, an outright recession is not on the horizon as the economy has been going through a “Rolling Recession” where most sectors take turns contracting, spreading the pain in the economy. By the end of 2024, most key sectors of the economy will have experienced a contraction. The overall result will be a ‘soft landing”. Despite the stronger-than-expected growth, the Federal Reserve is expected to cut the interest rate three to five times during the year cushioning the downdraft in the economy. The job market, though losing some strength, will remain healthy especially at the lower wage scale.

In summary, while 2023 was a good year, largely driven by consumer spending and government stimulus, the outlook for 2024 is more cautious. With various factors, including the anticipated effects of monetary policies and external geopolitical tensions, the economic landscape is poised for a phase of moderation. This shift underscores the need for strategic economic planning and vigilance to navigate potential challenges and sustain growth.