Trump said Tuesday the tariff rate on auto imports will be “in the neighborhood of 25 percent” which will be detailed on April 2, adding that he will give some a chance: “If they have a plant and factory here, there will be no tariff.”

Hyundai Motor and Kia, whose combined capacity currently stands at 696,100, aim to ramp up their capacity by 70 percent to some 1.2 million under the full operation of their massive plant in Georgia, which is slated to open in March.

“It may take some time but our ultimate goal is localizing production to minimize the influence of the tariff threat,” said Koo Za-yong, executive vice president of internal relations at Hyundai Motor during a conference call on Jan. 24, when asked how the company would respond to Trump’s tariff warnings.

“If the tariff issue is realized, Hyundai can cover up to 80 percent of U.S. sales with the U.S. production for now, as its Alabama plant has a capacity of 400,000 cars while the Georgia plant will have 350,000 units capacity.”

The automobile is the No. 1 export category in Korea’s export landscape, with its U.S. exports recording $34.74 billion last year, making up 27.2 percent of the country’s total U.S. exports.

IBK Economic Research Institute estimated that in a scenario of 25 percent duties, Korea’s auto exports to the United States will slump by 18.6 percent, or $6.36 billion.

![Vehicles wait to be exported at a port in Pyeongtaek, Gyeonggi, on Feb. 19. [YONHAP]](https://koreajoongangdaily.joins.com/data/photo/2025/02/19/51cd0ad2-3516-4683-b9a3-f9eb4f672e04.jpg)

KB Securities also said in a report that if Trump minimizes the rate to 10 percent, Hyundai Motor and Kia will suffer at least a 4.3 trillion won cut in operating profit. By simple calculation, with 25 percent tariffs, that influence could reach some 10 trillion won.

Kia, which even has a manufacturing plant in Mexico, is considering overhauling its supply chain and shipping most of its vehicles to Canada, as the two countries have no tariff system. Trump has previously declared 25 percent tariffs on all products coming from Mexico.

“Hyundai can offer the expansion of U.S. capacity as a bargaining chip on the negotiating table with Trump,” said Lee Hang-gu, a researcher at consulting firm Automotive Intelligence Networks. “But ramping up capacity means more investment. Hyundai has already invested much, and it is Trump’s tall order for it to do more.

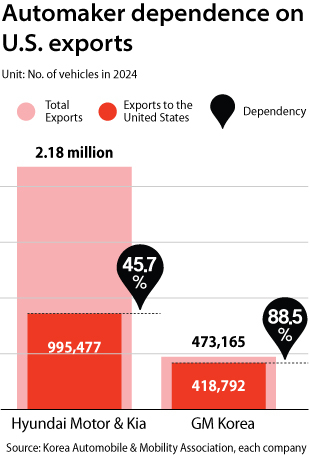

“The situation is very severe, even more solemn for GM Korea; almost 90 percent of their production ships to the U.S. market.”

GM Korea exported a total of 473,165 vehicles produced in its plants in Bupyeong, Incheon, and Changwon, South Gyeongsang, in 2024. Of them, 88.5 percent, or 473,165 units, were to the U.S. market.

![Hyundai Motor Group Executive Chair Euisun Chung, right, shakes hands with General Motors CEO Mary Barra after signing an agreement pledging cooperation in automobile development in New York. [HYUNDAI MOTOR]](https://koreajoongangdaily.joins.com/data/photo/2025/02/19/69895e79-f4ec-48c8-a1ab-a65d8687f5a9.jpg)

Another possible scenario could be using the production line of General Motors in the United States to cover growing U.S. sales.

Hyundai and General Motors in September inked a comprehensive alliance partnership covering the development and production of all types of vehicles.

The uplift of U.S. capacity, however, will have to tackle fierce opposition from labor unions, who have been standing against Hyundai’s investment in the United States due to its influence on domestic plants and their incentives.

Hyundai and Kia’s treaty with their labor union requires them to get workers’ approval if they wish to produce certain vehicle models in foreign countries.

Hyundai in 2021 pushed for the U.S. production of Palisade SUVs with the car’s surging popularity but ended up expanding capacity in domestic factories due to resistance from labor unions.

Kia’s labor union staged a protest last year opposing the automaker’s decision to manufacture EV9 EVs at its plant in Georgia.

BY SARAH CHEA [chea.sarah@joongang.co.kr]