The bankruptcy of fintech firm Synapse has left approximately 100,000 consumers unable to access their money, prompting increasing calls for a resolution to the nearly two-month-old issue.

Founded in 2014, Synapse connected financial apps with banks, supporting nearly 100 financial apps, including those for money management and rewards. These apps collectively served over 1 million users.

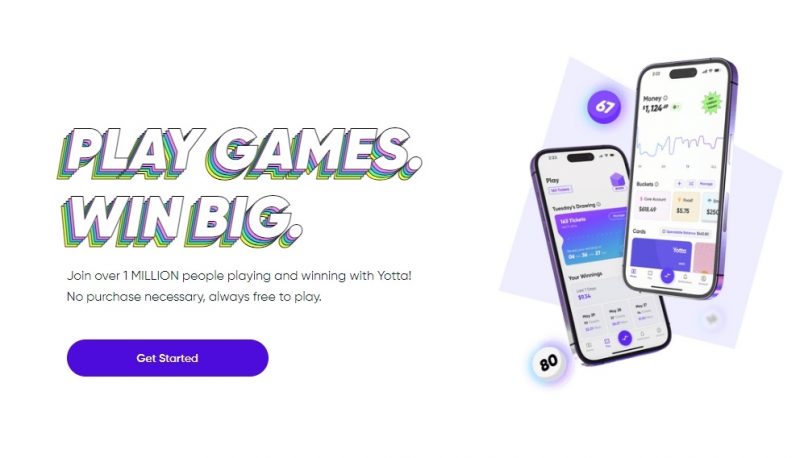

One of the most prominent examples of Synapse’s integration was Yotta, a rewards app offering checking accounts and lottery-like sweepstakes based on account balances, including daily $1 million cash giveaways.

Synapse facilitated Yotta’s partnership with Evolve Bank in Tennessee to provide these checking accounts. The app became highly popular, with over half a million downloads, leading to a significant increase in new accounts and deposits for Evolve Bank.

The crisis began when Synapse abruptly declared bankruptcy in May, leading to some deposits going missing. Amid mutual blame between Synapse and Evolve Bank, nearly 100,000 users had their accounts frozen, with over $265 million tied up.

FDIC deposit insurance is not applicable unless the bank is proven at fault. Yotta Co-Founder Adam Moelis expressed confusion and frustration, stating, “The money does not just disappear, it has to be somewhere.”

Jelena McWilliams, the former FDIC Chairwoman, has stepped in as the bankruptcy trustee. She highlighted that Synapse’s poor data management left transaction details incomplete, complicating efforts to determine individual customer deposits.

Nearly two months have passed with no resolution in sight, increasing anxiety among affected consumers who fear their money may be lost. Natasha Craft, one of the victims, had saved about $7,000 for her wedding.

She shared her frustration with CNBC, saying, “They made us believe that our money is FDIC insured at Yotta like how it was plastered all over the website. Finding out what FDIC really means is the biggest punch to the gut.”

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]