By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

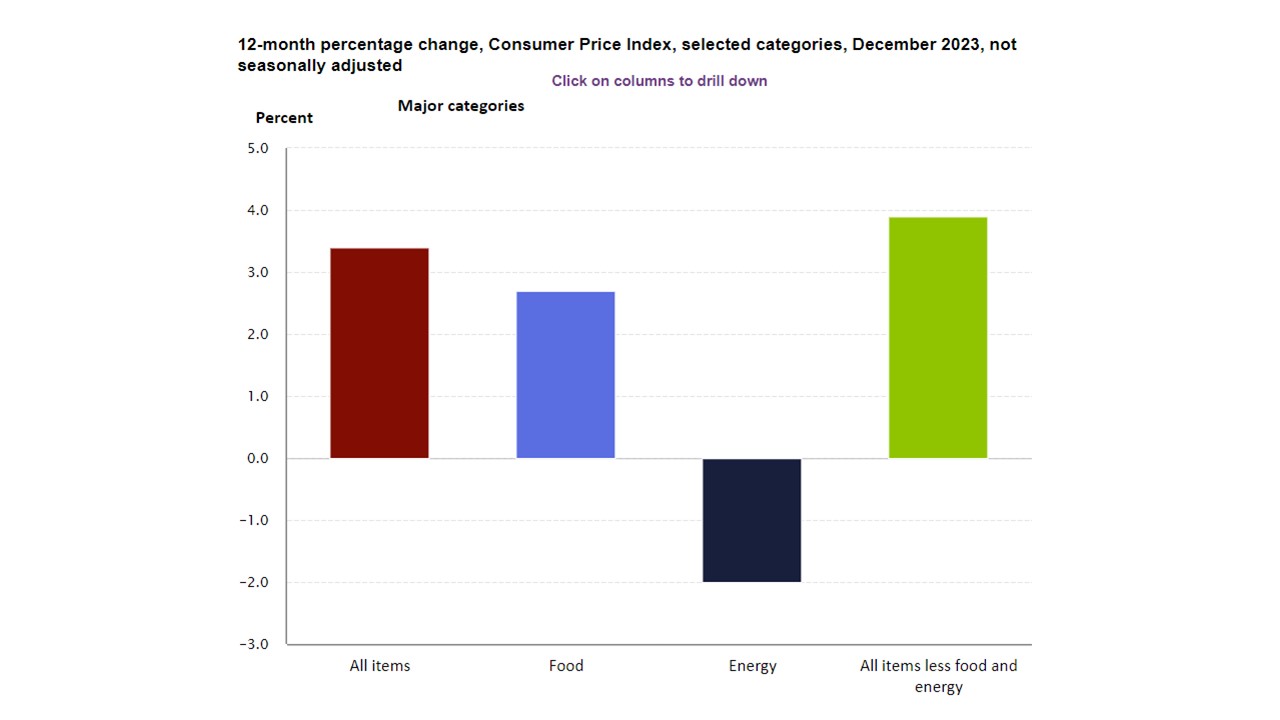

The cooling phase of inflation is a bumpy one. In December, the CPI accelerated to 3.4 percent from a year ago vs. 3.1 percent in November. The cost of shelter, which has a 35 percent weight in the index, was the worst offender.

Without it, the price increase would have been only 1.9 percent from a year ago. What is important is that the overall inflation trend is clearly downward from the peak of 9.1 percent in June 2022. A recent survey by the Federal Reserve Bank of New York showed that consumer inflation expectations for the next twelve months have fallen to 3 percent. The declining trend of the inflation rate suggests that peak interest rates in this cycle are behind us.

The Federal Reserve’s decision at the upcoming FOMC meeting scheduled for March 19-20 will tell us a lot about the future course of the interest rate; the decision will hinge critically on the future path of inflation. In the run-up to the March meeting, two additional CPI reports will provide further data for analysis. The CME Fed Watch Tool now predicts that there is a 62 percent probability of an interest rate cut in March and a 52 percent probability of two cuts by May.

The Federal Reserve will weigh the relative strengths of demand-pull vs. cost-push inflation. In recent months, goods prices have been falling. With supply shortages now largely in the rearview mirror, prices for commodities such as lumber, copper, energy, and new cars have been declining. Major retailers like Walmart and Target are bracing for potential price drops in a substantial portion of their merchandise in the upcoming months. Additionally, shelter prices, which have significantly fueled recent inflation, might soon exert a disinflationary influence.

However, not all inflationary pressures are demand-driven. A key concern for the central bank is the inflation in service prices, which is partly attributed to the tight labor market in sectors such as healthcare, leisure, hospitality, and construction. This has led to increasing costs for services ranging from dining out to personal care and home repair. Service prices excluding energy have risen 5.3 percent from a year ago. In December, the costs of medical care services rose 0.7 percent, the largest increase in the report.

This type of inflation, often termed “cost-push inflation”, may not react straightforwardly to changes in interest rates. Factors such as substantial labor settlements, hikes in minimum wages, and slow productivity growth are contributing to this inflationary pressure.

In summary, while there are clear signs of inflation cooling down, leading to expectations of lower interest rates. The course of future monetary policy will need to balance these mixed signals, considering both the encouraging trends in goods prices and the persistent challenges in the services sector. The next two CPI reports will be crucial in shaping the monetary policy for 2024 and beyond.