By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

The U.S. economy demonstrated resilience in 2024, maintaining healthy growth despite losing momentum during the final quarter of the year. Looking ahead, a key uncertainty lies in how the economic policies of the Trump administration will influence future growth.

Economic Performance in Q4 2024

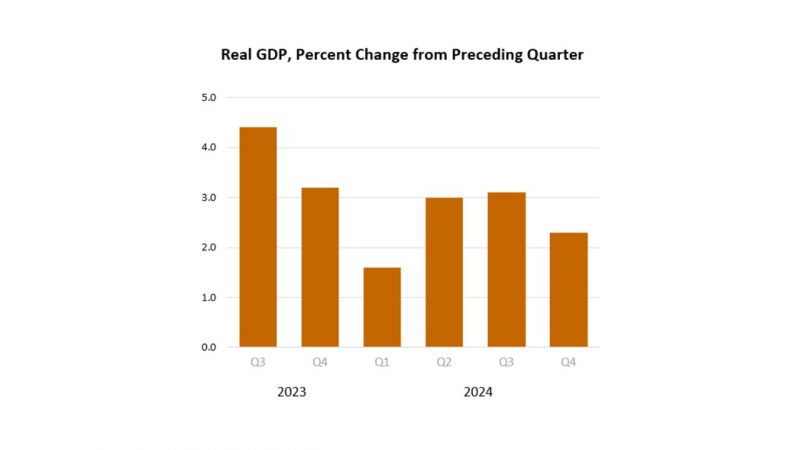

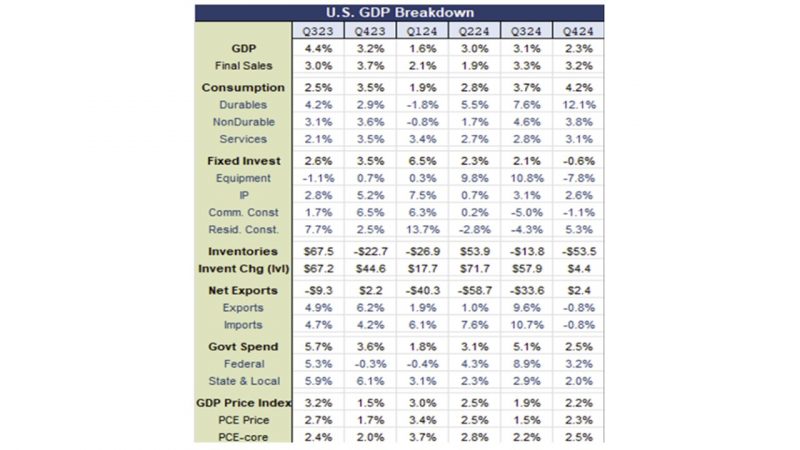

During the fourth quarter of 2024, economic growth exhibited a mixed trajectory, with GDP expanding by 2.3%, marking a slowdown from the 3.1% growth rate recorded in the third quarter. Household consumption continued to be the primary engine of economic expansion led by healthcare, recreational goods and vehicles. Rising incomes and a strong labor market underpinned this strength.

After contracting during the previous quarter, residential investment turned positive, driven by an undersupplied housing market and steady construction activity. However, affordability constraints and fluctuating mortgage rates poses challenges.

The trade gap expanded significantly, with the goods deficit reaching $122.1 billion in December, one of the highest on record. Businesses accelerated imports in anticipation of tariff hikes under the new administration, contributing to this widening deficit.

Capital expenditures in equipment and structures remained sluggish, despite a modest uptick in non-defense capital goods orders (excluding aircraft) in December. Policy uncertainty surrounding trade and tax regulations created a cautious investment environment, limiting overall business spending.

Key Economic Forces in 2025

As the economy moves into 2025, it stands at a crossroads, influenced by both expansionary and contractionary forces. The new administration’s policies to reduce regulatory burdens and implement additional tax cuts may stimulate economic activity by lowering compliance costs and increasing disposable income.

Higher tariffs could elevate import costs, leading to higher prices for businesses and consumers. Export-driven industries may face additional risks due to potential retaliatory trade measures. Higher import duties generally increase consumer prices and weaken the competitiveness of export industries. While some domestic businesses may benefit from reduced foreign competition, higher input costs could erode long-term growth.

Tighter immigration restrictions could reduce labor supply, pushing wages higher in industries facing worker shortages such as construction, agriculture, leisure and hospitality. A reduced labor supply may drive wages upward, benefiting some workers but also contributing to inflation.

Cutting red tape can reduce business costs, promote innovation and enhance market competition, often placing downward pressure on prices.

Lower taxes typically boost consumer spending and business investment in the short term. However, if the economy is near full capacity, increased demand could drive inflation higher. The long-term impact depends on whether tax cuts are deficit-financed, potentially leading to higher government borrowing costs.

The economic impact of Trump’s policies will depend on their timing and implementation. The effects of tariffs, immigration restrictions, deregulation, and tax cuts vary significantly.

The Path Forward

Lower taxes and streamlined regulations have the potential to enhance consumer and business confidence, drive investment, and stimulate long-term economic expansion. Thoughtfully designed policies can strengthen financial stability, create dynamic job markets, and sustain economic prosperity.

However, the outlook for 2025 hinges on achieving a delicate balance between competing economic forces. Decisions regarding tariffs, immigration, deregulation, and tax cuts will play a critical role in shaping both short-term performance and long-term stability. A measured approach—one that considers inflation risks while fostering growth—will be essential in maintaining a strong and resilient economy.

![Hangar images indicate North Korean advances in military drone domain Satellite photos taken on March 28, included in Beyond Parallel's report on North Korea, shows what appears to be seven new drone hangars at the Banghyon Air Base. [SCREEN CATPURE]](https://www.koreadailyus.com/wp-content/uploads/2025/04/0402-Hangar-100x70.jpg)

![Deeper-I, Efinix sign deal to develop world’s first AI-FPGA single-chip solution Ikuo Nakanishi, left, vice president of sales at Efinix and Lee Sanghun, right, CEO of Deep-I pose for a photo after signing MOU on March 26. [Provided by Deeper-I]](https://www.koreadailyus.com/wp-content/uploads/2025/04/0401-DeeperI-100x70.png)