Automakers are reorganizing their production and supply chains to meet eligibility requirements for electric vehicle (EV) tax credits, but the Trump administration’s decision to reevaluate the Inflation Reduction Act (IRA) has introduced new uncertainties for the EV industry.

On October 22, major media outlets reported that the White House had halted portions of spending authorized under the IRA and the Infrastructure Investment and Jobs Act (IIJA), both initiated under the Biden administration. Industry experts speculate that the federal EV tax credit, which offers up to $7,500 per vehicle, could end as early as this year.

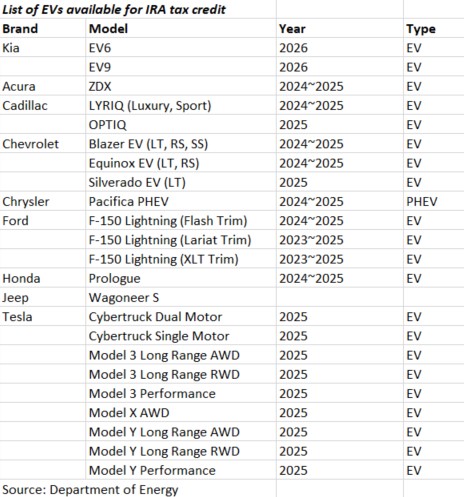

As a result, consumer interest is sharply focused on the updated list of eligible EV models. According to the IRS and the Department of Energy, only 23 models currently qualify for the IRA tax credit, down 42.5% from 40 models last year.

While federal funding for EV chargers and climate-related incentives has been curtailed, the scale of the cuts is reportedly narrower than initially expected. For this year, the tax credit applies to EVs with a manufacturer’s suggested retail price (MSRP) of up to $80,000 and remains capped at $7,500 per vehicle. All but one eligible model are fully electric, with only a single plug-in hybrid (PHEV) making the list.

Despite efforts by Hyundai and Kia to align with the IRA’s requirements, only two South Korean vehicles—Kia’s EV6 and EV9 SUVs—made the list. Models like Hyundai’s Ioniq 5, Ioniq 9, and Genesis GV70 EV were excluded, likely due to failing to meet the IRA’s critical battery mineral sourcing criteria. Hyundai has ramped up production at its Georgia-based Meta Plant, and analysts anticipate the company will meet the IRA’s specific requirements by mid-2024.

Tesla continues to dominate the list, adding its Cybertruck dual-motor and single-motor models to this year’s lineup, alongside existing eligible models like the Model 3 and Model Y in long-range and performance trims.

Other notable inclusions are Cadillac’s Lyriq and Optiq, Chevrolet’s Blazer EV, Equinox EV, and Silverado EV, as well as Ford’s F-150 Lightning series. However, automakers like Audi, Lincoln, Nissan, Rivian, and Volkswagen saw their models removed from the list this year.

Consumers planning to purchase an EV are advised to verify eligibility directly with dealerships, as not all trims of listed models qualify for the tax credit. For more information, visit the Energy Department and EPA’s joint website at fueleconomy.gov/feg/tax2023.shtml.

BY HOONSIK WOO [woo.hoonsik@koreadaily.com]