Big banks are running aggressive promotions to attract new customers, offering cash bonuses, where You can get up to $900 in cash if you take advantage of these offers.

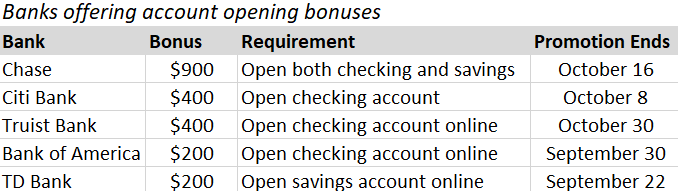

Some of the biggest banks with cash bonuses include Chase, Citibank, Bank of America, and TD Bank. Truist Bank, the 2019 merger of Branch Banking & Trust and SunTrust, joined the ranks.

Chase offers the highest bonus amount, although bonuses vary by account. If you open a checking and savings account, you can get $300 and $200, respectively. If you open both accounts at the same time, you’ll get an additional $400. That’s up to $900 just for opening two accounts.

Citibank and Truist Bank each offer $400 for opening a new checking account. Bank of America offers $200 for opening a checking account and TD Bank offers $200 for opening a savings account.

However, most bonuses require you to fulfill additional requirements beyond simply opening an account to receive the cash bonus. For Citibank and TD Bank, you’ll need to deposit at least $10,000 and maintain a balance for at least 90 days to qualify for the bonus. Bank of America’s minimum deposit is $2,000. Chase Bank and Truist Bank are less demanding at $500. However, all three banks require you to maintain a balance for at least 90 days to qualify for the bonus. TruistBank, Bank of America, and TD Bank all require you to open an account through their websites to receive the bonus.

The reason banks are aggressively trying to attract new customers is that in a high-interest-rate environment, it’s preferable to attract checking or savings accounts that pay lower interest rates than certificates of deposit (CDs), which pay higher yields, industry insiders said.

“When a bank offers CDs, it has to pay customers interest at a high rate for a certain period of time, which is expensive for the bank in a high-interest rate environment,” said one bank official, “so it’s better to have a lot of checking accounts that pay very little interest.”

“Once customers open an account, they don’t easily close it or move to another bank. One study found that the average account stays open for 17 years,” he added, meaning that banks have customers who will stay with them for 17 years.

“A few years ago, when rates were nearly at zero, $100 bonuses were the norm,” said Adam Stockton, Managing Director at banking data analytics firm Curinos. “In a high-interest rate environment, you have to offer something much better than that to attract customers.”

However, experts emphasized that it’s important to look at the terms of the account before opening it. Bonus-paying accounts may have higher rates of fees or other restrictions. “Make sure you read the fine print before opening an account,” said Marguerita Cheng, a financial planner.

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]