As more people use their smartphones to shop and send money online, consumers need to be on the lookout for increasingly sophisticated scams, including impersonations of well-known companies.

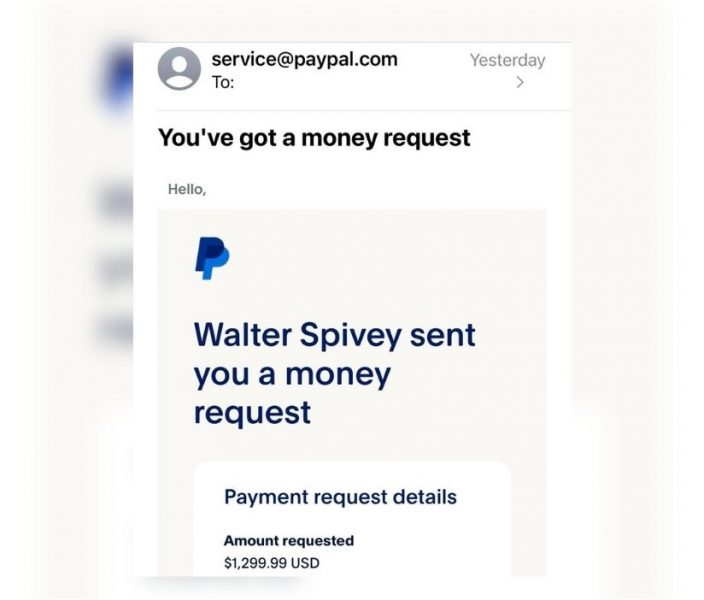

A Korean American college student, Jang was surprised to receive a PayPal email. It said that he had been charged $1,299.99 by someone he didn’t recognize. He thought it might be a scam, but the format of the email and the sender were both PayPal. The email also included a phone number to report the charge to PayPal if he didn’t recognize the sender or suspected fraud.

Jang searched the phone number just in case, and it turned out to be one of the numbers used by scammers based in the Philippines. After reporting the scam, Jang blocked the email sender, but it also blocked the official PayPal emails he had previously received, forcing him to delete them.

According to the Federal Trade Commission’s (FTC) recently released list of the top 10 companies impersonated in fraud last year, Best Buy topped the list with 52,000 cases, accounting for 39.4% of the 132,000 cases out of 10 companies. Amazon was second with 34,000 cases (25.8%) and PayPal third with 10,000 cases (7.6%).

Microsoft and Publishers Clearing House (PCH) accounted for 7,000 incidents each, Norton/Lifelock 6,000, Apple 5,000, Comcast/Xfinity and Bank of America 4,000, and Wells Fargo 3,000.

Fraudulent losses from these 10 companies totaled $208 million.

Microsoft accounted for $60 million, or 28.8% of the total, followed by PCH with $49 million (23.6%). Together, these two companies accounted for $190 million in damage, or 52.4% of the total.

Amazon followed with $19 million, then Apple with $17 million, PayPal with $16 million, Best Buy with $15 million, Norton and Wells Fargo with $11 million each, Bank of America with $8 million, and Comcast with $2 million.

The most common scams involving these companies involved the use of money transfer apps, including PayPal, Cash App, and Zelle, to obtain personal and financial information via email, text, or phone.

According to PayPal, 41% of fraud victimizations in 2022 were conducted via email or text.

The FTC recommends keeping your smartphone and computer’s OS and security software updated and using a combination of passcodes and security questions, not just passwords, to access your accounts.

In addition, if you receive a suspicious email or text message, you should never click or follow the link and always contact the impersonated company directly to verify.

BY NAKI PARK, HOONSIK WOO [park.naki@koreadaily.com]