In just three years, the most popular investment among Korean Americans has shifted from real estate to stocks. However, the overwhelming majority would invest in real estate if they could afford it.

While stability is the most important factor when investing, the preference for stocks is likely due to the unique circumstances of the pandemic, as people in their 30s and 40s are more risk-taking and aggressive investors.

As the value of assets such as house prices and stocks increased during the pandemic, more Koreans said they were well prepared for retirement. This is the result of the “2023 National Korean American Economic Survey” conducted by the Korea Daily. The survey polled 5,016 Korean Americans nationwide.

From real estate to stocks

Four out of five respondents (79.9%) said they invest from their spare funds. Most notably, the top investment choice has changed in three years. The number-one choice is stocks at 27.2%, up more than eight percentage points from 2020 (18.7%). Real estate, which was the top choice in the 2020 survey at 20.6%, dropped down to 18.1%. This is in line with the mainstream trend of the post-pandemic era, which has seen a sharp increase in equity investors. More than 50 million new stock accounts were opened in a year between 2020 and 2021 alone, according to market research firm BrokerChooser.

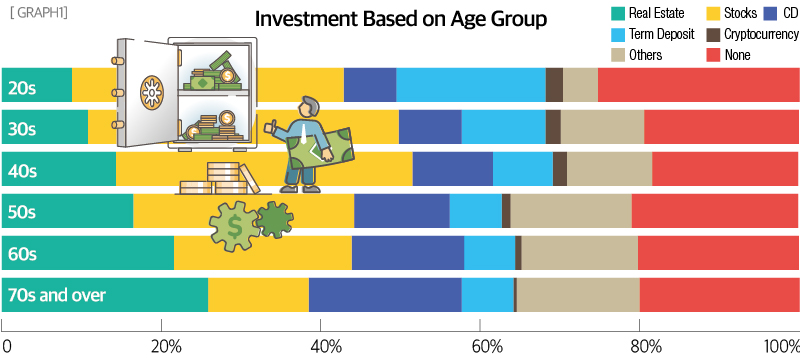

The preference for investing in stocks was evenly spread across all age groups but was more pronounced among those under 30. (See Graph 1) In 2020, 23.2% and 29.7% of the 20s and 30s, respectively, said stocks were their primary investment. In last year’s survey, the numbers were 34.1% and 39.0%, far exceeding the figures from three years ago.

The younger generation’s stock investing craze is not just limited to the Korean-Americans. According to a 2023 survey by CNBC, 63% of adults between the ages of 18 and 34 believed they could build wealth through stock investing.

Investing in certificates of deposit (CDs) has also increased significantly. More than 5 percentage points more than in 2020, 12.7% of people said CDs are their primary investment. This is because interest rates rose steeply from 2022, with high interest rates hovering around 5%, depending on the amount and maturity. CDs, on the other hand, fell from 13.0% to 7.1%. It is also noteworthy that the share of cryptocurrencies has tripled to 1.2%, up from just 0.4% in 2020. Other responses included investing in bonds, gold, insurance products, mutual funds, and money markets.

Real estate is still the most desired investment

When asked where they would like to invest, real estate topped the list with nearly 7 in 10 (71.1%) respondents. Stocks came in second at 51.3%. This suggests that Korean Americans who have invested in stocks, CDs, cryptocurrencies, and other relatively small investments would like to invest in real estate if they had enough money to spare. In fact, those in their 20s and 30s who ranked stocks as their top investment priority were more likely to say they would like to invest in real estate than those in their 50s and 60s.

The percentage of respondents who wanted to invest in CDs jumped from 9.9% in the 2020 survey to 27.6% in 2023, ranking third, followed by time deposit (20.4%), bonds (16.8%), and mutual funds (12.4%). Those who wanted to invest in gold reached 25.0% in 2020, but by 2023, that number had halved to 12.0%. This is likely because gold’s popularity as a safe haven asset during the pandemic has waned.

Aggressive investment in the 30s and 40s

When it comes to investing, stability, such as principal protection, was the most important thing for Korean Americans. More than half of the respondents, 55.7%, prioritized stability. Profitability came in second at 30.3%.

Stability was also the top priority in the 2012 and 2020 surveys, which may have been influenced by unstable economic conditions such as the financial crisis and pandemic. The rise of stability as the number one priority in this survey is related to the fact that the Korean American community has entered an aging phase, with a significant increase in retirees. Those over the age of 50 were more likely than average to say they value stability.

On the other hand, those in their 30s and 40s valued profitability the most, at 38.7% and 38.4%, respectively. While stability was also highly valued, it was still about 10% below the overall average. This explains that people in their 30s and 40s, who are far from retirement age but can afford to invest, are focusing on profitability and investing in comparatively riskier assets such as stocks.

About retirement plans, 54.1% of respondents said they are preparing for retirement, which was not much different from the 2020 survey. The higher the income, the higher the proportion of respondents who say they are preparing for retirement. Only 26.9% of those making less than $30,000 said they were saving for retirement, compared to 82.5% of those making $200,000 or more.

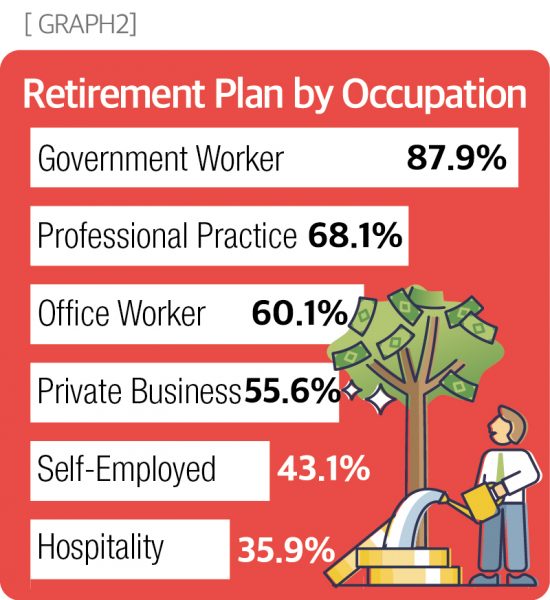

Retirement planning varied by occupation. (See Graph 2) Nearly 90% of government employees, who have relatively stable retirement plans, say they have a retirement plan. This was followed by people working with professional practice (68.1%), office workers (60.1%), and private business (55.6%). The percentages for self-employed and hospitality workers were lower than the overall average at 43.1% and 35.9%, respectively with the difference between government workers and service workers being 2.5 times higher.

The reasons for the lack of retirement preparedness in the hospitality industry and the self-employed sector can be attributed to their relatively low incomes and lack of access to workplace retirement accounts.

When asked how they are preparing for their retirement, respondents gave a variety of answers, including individual retirement accounts such as IRAs (57.3%), workplace retirement accounts like 401(k) (51.8%), social security (32.8%), insurance (32.5%), bank deposits (27.6%), real estate (24.3%), and stocks (20.1%). Survey respondents were using a variety of methods to prepare for retirement, rather than relying on a single source.

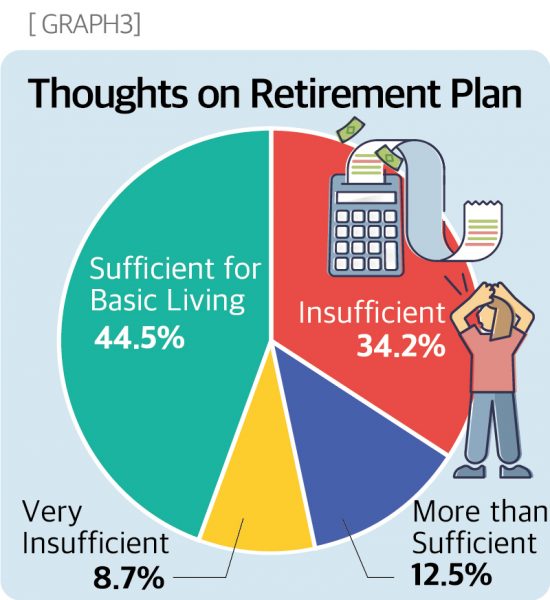

Satisfaction with retirement preparedness has changed significantly from three years ago. (See Graph 3) In 2020, the number of respondents who said they would be very short of money to the point of being unable to live a basic life dropped from 21.3% to less than half (8.7%). The percentage of people who say they have enough for basic needs has increased significantly in three years, from 35.5% to 44.5%, while the percentage of people who say they have enough has increased slightly.

Experts attributed the increase to rising stock prices during the pandemic, which boosted retirement accounts and the value of real estate, which accounts for a significant portion of Korean Americans’ wealth. In 2023, a study released by Fidelity found that workplace retirement account balances increased 14% year-over-year, and the number of accounts with balances of $1 million or more increased 11.5% year-over-year.

The New York Times (NYT) also noted this trend in its 2022 article on pandemic-era retirees, saying that “many retired at earlier ages than expected as stock and home values soared.” In fact, the value of Korean Americans’ homes has also increased significantly. It is analyzed that the value of Korean Americans’ major assets such as workplace pensions and real estate has increased, and the number of respondents who said they were able to live a basic life after retirement has increased.

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]