Changes in the economic structure are showing an accelerated generational shift in the Korean-American community.

According to an analysis of the “National Korean American Economic Survey” conducted by the Korea Daily last year, the most notable changes were the decrease in the number of self-employed people and the increase in the number of retirees. In addition, the high inflation rate that began in 2021 has led to a deterioration in household finances and an acceleration in polarization as living expenses have increased.

The survey was sponsored by Bank of Hope, and 5,016 Korean Americans nationwide participated in the survey. The survey was conducted three years after the 2020 survey to track changes in the economic situation of Korean Americans.

The most prominent finding of the survey was the generational shift in the Korean-American community. The percentage of retirees was 17.6%, in contrast to 3.2% in 2012. In 2020, it rose to 11.9%, which went up by 8.7 percentage points in eight years. In just three years, the percentage jumped 5.7 percentage points again to 17.6%.

The annual growth rate of Korean-American retirees is accelerating. The first-generation Korean Americans who were the mainstay of the economy are retiring from the workforce, and in many cases, second- and third-generation Korean Americans are taking over their parents’ businesses.

With the generational shift in full swing, the percentage of self-employed Koreans has also declined. In 2020, it was 19.6%, down 4.8 percentage points from 24.4%. This is the first time in five surveys since 2006 that the self-employment rate has fallen below 20%.

Overall income levels among Korean Americans rose with the inflation. The percentage of Korean Americans earning less than $50,000 per year was 36.9%, down significantly from 2012 (48.8%) and 2020 (48.0%).

Experts say the survey results show that Korean Americans have recovered from the temporary drop in income during the pandemic, as well as government stimulus programs and investments in stocks and cryptocurrencies.

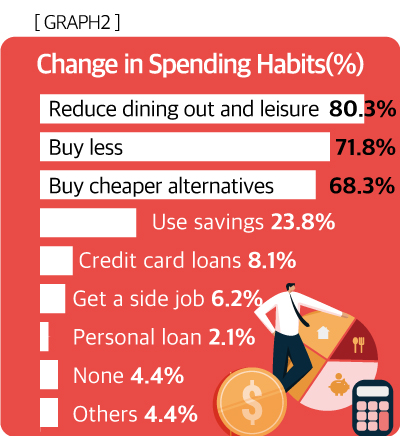

The Korean-American community has seemingly recovered from the pandemic but is struggling with increased spending due to inflation. According to the survey, more than eight out of 10 Koreans say their living expenses have increased, and more than 70% say their household finances have worsened. Those with low incomes are particularly hit harder, and it has been pointed out that high prices have exacerbated polarization. To cope with the economic challenges, many have opted to tighten their belts rather than generate additional income.

At the height of the pandemic in 2020, 69% of respondents said their income had decreased. However, in the last year, more respondents said their household income has stayed the same or increased compared to a year ago. This shows a modest recovery from the steep drop in income during the pandemic. For the self-employed, more than half of them reported a decrease in income compared to a year ago.

Accelerating Polarization of Korean Americans

In the wake of the pandemic, 81.9% of respondents said they have increased their living expenses. More than seven out of 10 Koreans (70.8%) said that high prices have worsened their household finances. This parallels the data released by the Federal Reserve in May, where 65% of respondents said inflation made life harder in 2023.

Those with lower incomes were more likely to say their household finances were worse off. While 78.8% of those earning less than $30,000 per year said their household finances had worsened, only 46.5% of those earning more than $200,000 per year said the same.

Across all income groups, less than 1% of respondents said their households were better off, but it was as high as 3.7% of those earning $200,000 or more, indicating a widening gap between the rich and poor in the Korean-American community. The biggest increase in expenditure due to rising prices was on groceries (60.7%). Gasoline (13.7%) and housing (10.9%) also had a significant impact on living expenses.

Saving Rather than Earning Extra Income

As the burden of living expenses increased, Korean-American consumers cut back on spending. As many as 80.3% of respondents cut back on eating out and leisure expenses. This was followed by reducing overall purchases (71.8%) and buying cheaper alternatives (68.3%). After saving expenses, the next most common response was using savings (23.8%). However, only 6.2% of Koreans took on side jobs to earn extra income.

Office Workers Are Less Affected by High Prices

For 50.8% of office workers, their household income has not changed. While 22.0% of them said their income increased, 24.2% reported a decrease in income. This is a significant change from the 2020 survey, where 69% of respondents said their financial situation had worsened, indicating that Korean Americans have returned their incomes to pre-pandemic levels.

In terms of jobs, 71.2% said there has been no change in the past six months. Another 10.2% said they had retired or are planning to, and 12.4% said they had changed jobs or are considering it.

Self-Employed Are Getting Hit Hard by Inflation

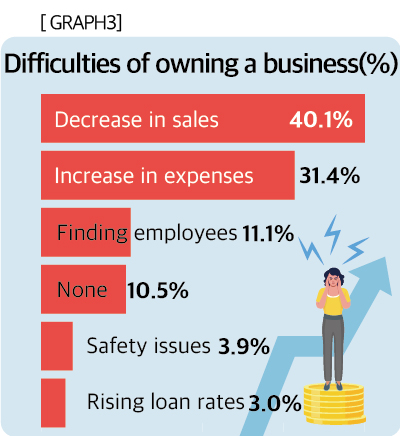

Unlike employed workers, business owners and the self-employed have been hit hard by high inflation. Of those who are self-employed, 53.7% say their revenue is down from a year ago, while 27.7% say it’s about the same. Only 13.7% reported an increase in sales.

The largest proportion of those reporting a decrease in revenue were those with a 20% decrease or less (31.9%). This was followed by 30% down or less (27.8%) and 40% or less (18.3%). Another 12.5% reported a drop of more than half. One respondent who is a restaurant owner said, “We have seen a significant decrease in sales due to rising costs from high inflation, as well as steeply rising labor costs.”

The top two items on the list of business challenges were decreased revenue (40.1%) and increased expenses (31.4%). Finding employees (11.1%), security issues (3.9%), and rising loan interest (3.0%) were also cited as factors that made entrepreneurship challenging.

Purpose and Methodology

The survey was conducted to accumulate data on the economic life of Korean Americans and to understand the changes in the Korean American economy, especially after the COVID-19 pandemic, and the impact of inflation on the Korean American community. The study was conducted from September 22 to October 26 of last year through Korea Daily’s website, koreadaily.com. The survey was conducted online through a self-reporting method using a structured questionnaire, and 5,016 Korean Americans nationwide participated. The results of the survey will be presented in the following series: Inflation’s Impact, Changes in Occupation, Income, and Housing, Investment Status and Retirement Plans, and Usage of Korean American Banks.

BY WONHEE CHO, HOONSIK WOO [cho.wonhee@koreadaily.com]