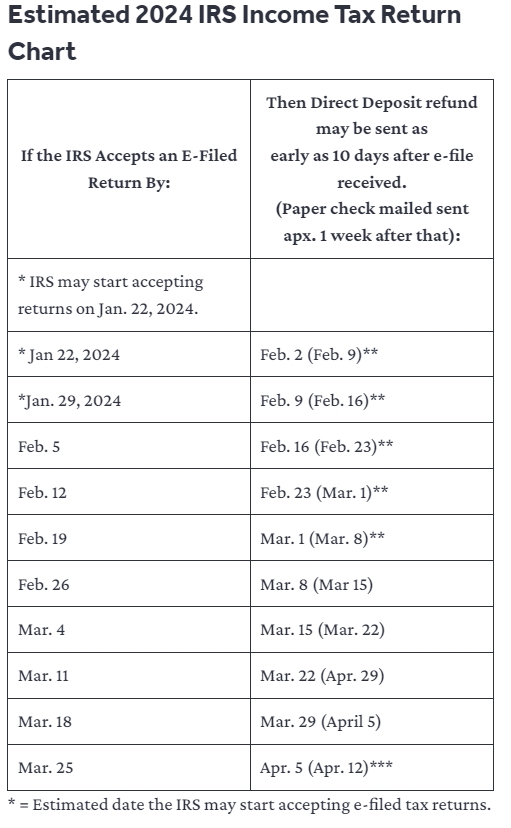

The Internal Revenue Service (IRS) has announced that this year’s e-file refunds will be directly deposited into taxpayers’ bank accounts. These deposits are expected within 10 days of the IRS receiving the returns, indicating the anticipated refund dates.

CPA Practice Advisor’s latest e-file refund estimates for the 2024 tax season suggest refunds will be in bank accounts an average of 11 days after the IRS confirms the return online.

Taxpayers filing on January 22, the first day of returns, should expect refunds by February 2 via online direct deposit. Those receiving checks can anticipate them by February 9, a one-week delay.

Refund deposits can be tracked on the IRS website (IRS.gov) or the mobile app (IRS2Go). Taxpayers unable to meet the April 15 deadline may file Form 4868 for an automatic extension to October 15.

Tax specialists advise seeking advice for major income changes or life events like birth, marriage, divorce, retirement, home purchases, or investment shifts.

BY NAKI PARK, JUNHAN PARK [park.naki@koreadaily.com]