Less than 10 electric vehicle (EV) models will qualify for the $7,500 tax credit next year due to tighter Inflation Reduction Act (IRA) rules.

Beginning January 1 next year, only 10 EVs will be eligible for the full $7,500 federal tax credit, owing to the more stringent IRA eligibility criteria, according to CarBuzz. However, the 2023 Chevrolet Bolt EV is expected to be discontinued, leaving only nine tax credit-eligible EVs for consumers to choose from.

EVs that contain battery components manufactured or assembled by Foreign Entities of Concern (FEOC) will not be eligible for the credit starting next year, according to the IRA details released by the Treasury and Energy departments. Starting in 2025, EVs using critical minerals from FEOC will not qualify for the tax credit.

FEOC, as defined by the Department of Energy’s guidance, includes companies owned, controlled, or under the jurisdiction of the governments of China, Russia, North Korea, and Iran.

From next year onwards, to qualify for the credit, at least 60% of battery components must be assembled in North America, and 50% of key minerals must be extracted or processed in the U.S. or a country with a trade agreement. The percentages increase by 10% each year.

Qualifying vehicles must still cost no more than $55,000 for sedans and $80,000 for trucks and SUVs, but the $7,500 credit will be applied at the point of sale to help lower monthly payments.

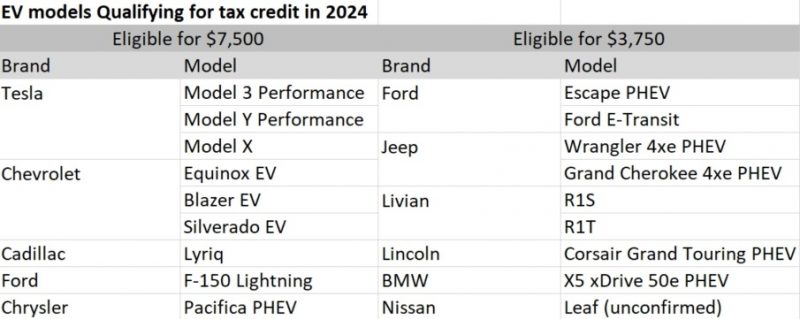

Under the enhanced rules, nine vehicles will qualify for the $7,500 credit next year, including Tesla’s Model 3 Performance, Model Y Performance, and Model X, as well as the Chevrolet Equinox EV, Blazer EV, Silverado EV, Cadillac Lyriq, Ford F-150 Lightning, and Chrysler Pacifica plug-in hybrid (PHEV).

By manufacturer, the list features four from GM, three from Tesla, and one each from Ford and Chrysler.

Vehicles that certify for the battery component requirement will also be eligible for the $3,750 tax credit next year.

The qualifying vehicles are BMW X5 xDrive50e PHEV, Ford Escape PHEV, Ford E-Transit, Jeep Wrangler 4xe PHEV, Jeep Grand Cherokee 4xe PHEV, Lincoln Corsair Grand Touring PHEV, Livian R1S and R1T, and the Nissan Leaf (unconfirmed).

Models previously eligible for the credit but excluded next year include the Genesis GV70 EV, Ford Mustang Mach-E, Volvo S60 Recharge, Audi Q5 TFSI eQuattro PHEV, and BMW 330e.

“There are too many foreign companies that were suddenly stripped of the credit, even though they are currently building cars in the U.S.,” said CarBuzz. “A gradual transition to the new rules should have given these corporations time to pivot their supply chain.”

Additional information on the tax credit can be found at fueleconomy.gov/feg/taxcenter.shtml.

BY NAKI PARK, HOONSIK WOO [park.naki@koreadaily.com]