By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

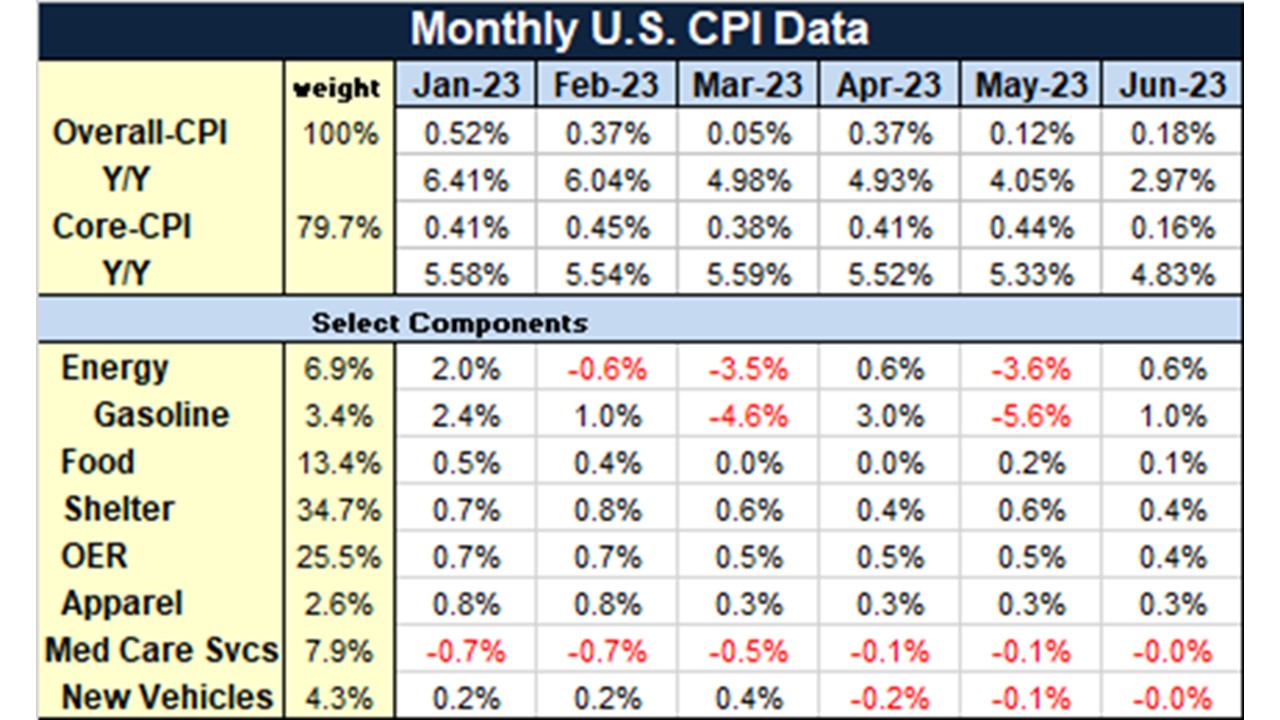

The Fed’s fight against inflation is working but it is too early to declare victory. The core rate of inflation, excluding food and energy, rose 4.8 percent from a year ago, well above the central bank’s 2 percent target. There will be more hikes in the interest rate. It needs to see a sustained slowdown in employment and wage gains.

However, there are some hopeful signs that the headline inflation rate will keep decelerating in the coming months. Fed’s core service CPI excluding shelter remained below 4 percent. Shelter costs, which account for about a third of the CPI, showed the biggest increase. However, apartment rents in the marketplace have been decreasing for some months; this should begin to be reflected in the CPI-shelter soon.

New and used car prices are another positive sign. During the pandemic, new and used car prices rose to lofty levels. After reaching their peak earlier this year, new car prices have been trending down as production exceeds supply. Automakers are preparing for a price war, and some electric vehicle makers have already slashed prices. With increasing production of new cars, the prices of used cars peaked earlier this year and will continue to trend down. Food and energy costs, which have been behaving well should not be a significant contributor to future inflation.

For the Federal Reserve to feel more comfortable about the inflation picture, a significant loosening of the job market is crucial. The job market is still tight, especially in services including healthcare as well as leisure and hospitality. There are a lot more job openings than the available labor supply leading to low jobless rate and rapid wage growth.

Higher labor costs are being passed along to consumers. The labor force participation rate is still below the pre-pandemic high. Labor costs adjusted for productivity gains, which is the most important factor determining the future trajectory of inflation, have been moving in the wrong direction. The labor shortages won’t ease anytime soon. In addition, wages have not kept up with inflation in this recovery.

Since monetary policy works with a significant lag, there is a risk that FOMC could push the economy into a real economy-wide recession. Even though the July hike in the interest rate is fait accompli, the Fed should consider standing pat for a while. Stay tuned for Chairman Powell’s Jackson Hole speech in August.

<CPI for June 2023>