Due to high prices, nearly seven out of 10 consumers are in worse financial situation than last year.

Experts pointed out that spending $445 more per month on the same goods and services as last year is inevitable because of inflation.

Additional monthly expenditure of $445 due to inflation

a series of increases in gas costs, insurance, etc

Earnings per hour are down 0.1 percent

29% “I’m running out of all my savings”

According to the September inflation report released by the Federal Bureau of Labor Statistics (BLS), the consumer price index (CPI) rose 8.2% year-on-year. This is the highest level since the early 1980s.

Inflation has reduced most consumer living standards. According to a survey by Salary Finance, 66 percent of workers have been financially struggling since a year ago due to inflation. In addition, 32% of the respondents said they were always pressed for money before the next pay period after receiving the salary.

“Overall, workers are struggling financially regardless of gender, race, ethnicity, or income,” said Salary Finance CEO Ash Soccer. “Even about half of the workers who earn more than $100,000 have difficulty living and reduced their savings compared to last year.”

With high inflation, consumers are paying $445 more per month than a year ago to buy the same goods and services, according to BLS.

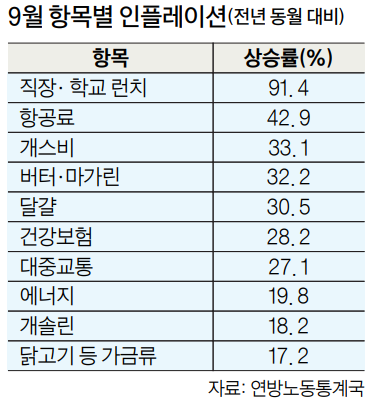

As of September, the highest inflation item was the cost of work and school lunch, up 91.4% from the previous year. Figures have proved the “lunch inflation” that office workers feel with their skin. Airfare (42.9%), Gasbee (33.1%), Butter and Margarine (32.2%), Eggs (30.5%), Health Insurance (28.2%), Public Transportation (27.1%), and Galin (18.2%) rose sharply. (See Table)

Prices have risen to the ceiling, but consumers’ purchasing power has declined as workers’ wages have failed to keep up with inflation.

High inflation has reduced the average hourly income of workers by 0.1% during the month, and hourly wages as of September have fallen by an average of 3% over the past year.

As the economic situation worsened, many consumers made a living by tearing down their savings.

According to the Moody’s report, 72% of consumers have fewer savings than last year. This is a 17 percentage point jump from 55% in February. Twenty-nine percent of the respondents said they spent all their savings.

The options to save living expenses are also decreasing as the high inflation rate does not stop.

“It is important to separate fixed costs such as mortgages, rent, and food from voluntary costs such as dining out and vacation,” said Madeline Maroon, financial adviser to California Financial Adviser. “We need to review items that are spent every month such as clothing and subscription services.”

by Lee Eun-young